Ultimate Guide To Swift BIC Code For Bancolombia: Secure And Efficient Global

The Swift BIC Code (Business Identifier Code) for Bancolombia, a prominent Colombian banking institution, is COLOCOBOMMDA. This alphanumeric code facilitates seamless and secure international wire transfers, enabling businesses and individuals to transact with global counterparts and beneficiaries.

The Swift BIC Code plays a crucial role in the global financial system, ensuring efficient and error-free cross-border transactions. It identifies the specific bank involved in the transfer, allowing funds to be directed accurately and promptly. Historically, the adoption of the Swift BIC Code has standardized international banking communications, enhancing transparency and reducing the risk of fraud.

This article delves into the Swift BIC Code for Bancolombia, exploring its composition, significance, and practical implications for international money transfers.

Swift Bic Code For Bancolombia

The Swift BIC Code for Bancolombia, COLOCOBOMMDA, plays a vital role in international money transfers, ensuring secure and efficient transactions. Understanding its key aspects is crucial for businesses and individuals engaging in global financial activities.

- Bank Identification: Uniquely identifies Bancolombia in international banking transactions.

- Country Code: CO represents Colombia, where Bancolombia is headquartered.

- Location Code: OB indicates Bogota, the location of Bancolombia's head office.

- Branch Code: MMDA specifies the specific branch involved in the transfer.

- Verification: The check digit aids in error detection during transmission.

- International Standard: Adheres to the ISO 9362 standard for international bank identification.

- Global Connectivity: Enables Bancolombia to participate in the Swift network, facilitating worldwide transactions.

- Security: Enhances the security of international money transfers by preventing unauthorized access.

- Efficiency: Expedites cross-border payments by eliminating intermediaries and automating the process.

- Transparency: Provides clear identification of the banks involved, reducing the risk of fraud.

These aspects collectively underpin the effectiveness and reliability of the Swift BIC Code for Bancolombia. It allows for accurate and timely international money transfers, supporting global trade and financial operations.

Bank Identification

Within the context of the Swift BIC Code for Bancolombia, bank identification plays a crucial role in ensuring secure and accurate international money transfers. It uniquely identifies Bancolombia among the numerous financial institutions worldwide, streamlining the process and reducing the risk of errors.

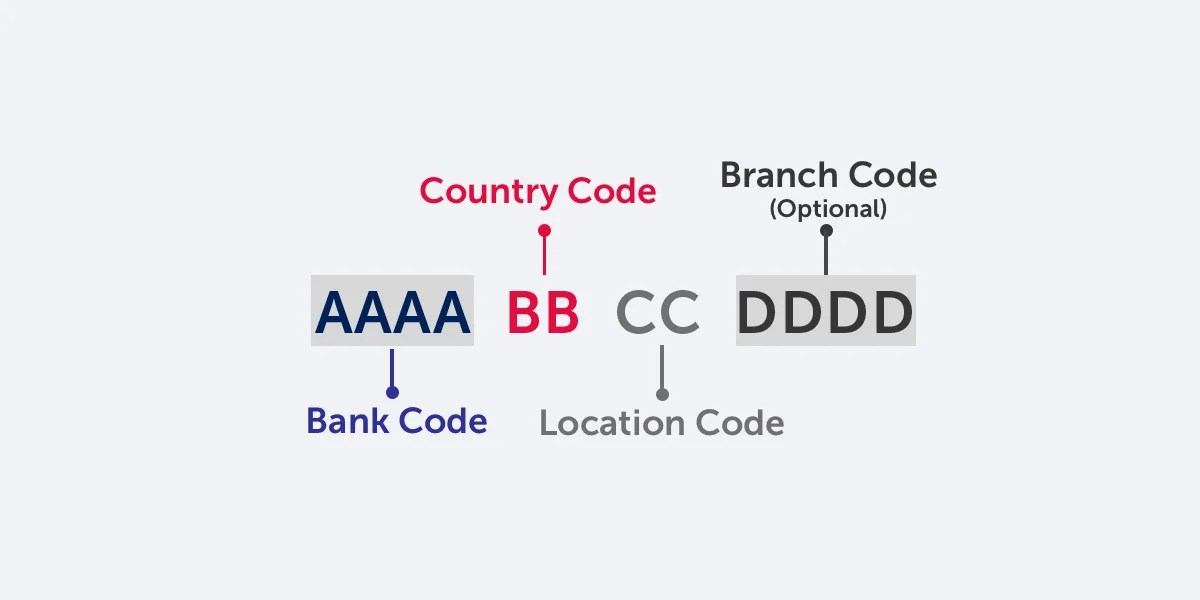

- Bank Code: The unique identifier assigned to Bancolombia within the Swift network, differentiating it from other banks.

- Country Code: The two-letter code representing Colombia, where Bancolombia is headquartered, facilitating international recognition and routing.

- Location Code: A code indicating the specific city or region where Bancolombia's head office is located, ensuring precise identification within the country.

- Branch Code: An optional code specifying a particular branch of Bancolombia involved in the transaction, allowing for further granularity in fund transfers.

By incorporating these elements, the Swift BIC Code for Bancolombia uniquely identifies the bank and its branches, enabling seamless and efficient international money transfers. It eliminates confusion and potential errors that could arise from similar bank names or locations, ensuring that funds reach their intended destination swiftly and securely.

Country Code

The country code "CO" within the Swift BIC Code for Bancolombia serves as a critical identifier, establishing the bank's geographical location and facilitating efficient international money transfers. As part of the Swift BIC Code structure, the country code plays an integral role in ensuring accurate and timely cross-border transactions.

The country code serves as a unique designator for Colombia, distinguishing Bancolombia from other financial institutions worldwide. By incorporating the country code into the BIC, it becomes easier to identify the bank's headquarters and the regulatory environment under which it operates. This simplifies the routing of international payments and reduces the risk of errors or delays.

Real-life examples further illustrate the importance of the country code within the Swift BIC Code for Bancolombia. When initiating an international money transfer, individuals or businesses need to provide the BIC code of the recipient bank. By including the country code "CO," they ensure that the funds are directed to the correct country and the corresponding financial system. This precision is crucial for seamless and secure international transactions.

Understanding the connection between the country code "CO" and the Swift BIC Code for Bancolombia is essential for businesses and individuals engaging in global financial operations. It enables them to accurately identify the bank and its location, ensuring that international money transfers are processed efficiently and reach their intended destination without delay.

Location Code

Within the Swift BIC Code for Bancolombia, the location code "OB" serves as a vital element in identifying the bank's geographical presence and facilitating efficient international money transfers. This code plays a crucial role in ensuring that funds are routed to the correct branch or location, reducing the risk of delays and errors.

- Bank Identification: The location code helps to uniquely identify Bancolombia's head office in Bogota, distinguishing it from other branches or subsidiaries within the country.

- Routing Efficiency: By specifying the location of the head office, the code ensures that international payments are directed to the appropriate regional or central processing center, expediting the transfer process.

- Regulatory Compliance: The location code aligns with regulatory requirements in certain countries, which may mandate the identification of the bank's head office for cross-border transactions.

- Accuracy and Precision: The inclusion of the location code enhances the accuracy and precision of international money transfers, minimizing the risk of misdirected funds or delays due to incorrect routing.

Understanding the significance of the location code "OB" within the Swift BIC Code for Bancolombia is crucial for businesses and individuals engaging in international financial transactions. It ensures that funds are transferred securely and efficiently to the intended recipient, fostering seamless cross-border commerce and financial operations.

Branch Code

Within the Swift BIC Code for Bancolombia, the branch code "MMDA" plays a crucial role in specifying the particular branch involved in an international money transfer. This code serves several important functions and has implications for both businesses and individuals.

- Branch Identification: The branch code uniquely identifies the specific Bancolombia branch responsible for processing the international money transfer. This ensures that funds are directed to the correct location for further processing and distribution.

- Routing Efficiency: By specifying the branch code, the Swift BIC Code facilitates efficient routing of international payments. It enables financial institutions to identify the appropriate correspondent bank or intermediary for the transfer, reducing delays and minimizing the risk of errors.

- Regulatory Compliance: In certain countries, regulatory requirements may mandate the inclusion of the branch code in international money transfers. This helps ensure compliance with anti-money laundering and other financial regulations.

- Accuracy and Precision: The inclusion of the branch code enhances the accuracy and precision of international money transfers. It helps prevent misdirected funds or delays due to incorrect routing, providing peace of mind for businesses and individuals.

Understanding the significance of the branch code "MMDA" within the Swift BIC Code for Bancolombia is crucial for businesses and individuals engaging in international financial transactions. It ensures that funds are transferred securely and efficiently to the intended recipient, fostering seamless cross-border commerce and financial operations.

Verification

Within the Swift BIC Code for Bancolombia, the check digit plays a critical role in ensuring the accuracy and reliability of international money transfers. It serves as a safeguard against errors that may occur during transmission, helping to maintain the integrity of financial transactions.

The check digit is a calculated value derived from the other characters in the Swift BIC Code. When the code is transmitted electronically, the check digit is included as a means of error detection. If any errors occur during transmission, the check digit will not match the calculated value, indicating that the code has been corrupted.

Real-life examples demonstrate the importance of the check digit in the Swift BIC Code for Bancolombia. In cases where transmission errors have occurred, the check digit has successfully identified the error, preventing incorrect routing of funds. This safeguards against unauthorized access to accounts and ensures that funds are transferred securely and accurately.

Understanding the role of the check digit in the Swift BIC Code for Bancolombia is crucial for businesses and individuals engaging in international money transfers. It provides confidence in the accuracy and reliability of the code, reducing the risk of errors and ensuring the secure transfer of funds.

International Standard

The Swift BIC Code for Bancolombia adheres to the ISO 9362 standard, an international standard for bank identification. This standard ensures that the BIC code is consistent and reliable, enabling accurate and efficient international money transfers.

The ISO 9362 standard defines the format and structure of the BIC code, ensuring that it is unique and recognizable worldwide. Each character within the BIC code has a specific meaning, such as the country code, bank code, and branch code. By adhering to this standard, the Swift BIC Code for Bancolombia is recognized and processed seamlessly by financial institutions around the globe.

Real-life examples demonstrate the importance of the ISO 9362 standard for the Swift BIC Code for Bancolombia. When businesses or individuals initiate international money transfers, they rely on the BIC code to ensure that funds are routed correctly. The ISO 9362 standard ensures that the BIC code is consistent and accurate, reducing the risk of errors or delays.

Understanding the connection between the ISO 9362 standard and the Swift BIC Code for Bancolombia is crucial for businesses and individuals engaging in international financial transactions. It provides confidence in the accuracy and reliability of the BIC code, facilitating secure and efficient cross-border payments.

Global Connectivity

The Swift BIC Code for Bancolombia is intricately connected to the bank's global connectivity, which enables its participation in the Swift network. This network serves as a vital infrastructure for international money transfers, facilitating secure and efficient transactions worldwide.

The Swift BIC Code serves as a unique identifier for Bancolombia within the Swift network. It allows the bank to seamlessly connect with other financial institutions worldwide, enabling cross-border payments to be processed quickly and accurately. Without global connectivity and participation in the Swift network, Bancolombia would be limited in its ability to facilitate international money transfers, hindering global commerce and financial operations.

Real-life examples illustrate the practical significance of Bancolombia's global connectivity. Businesses and individuals rely on the Swift BIC Code to initiate international money transfers, trusting the Swift network to securely and efficiently route funds across borders. This connectivity empowers Bancolombia to play a vital role in facilitating global trade, foreign direct investment, and remittances.

Understanding the connection between global connectivity and the Swift BIC Code for Bancolombia is crucial for businesses and individuals engaging in international financial transactions. It provides confidence in the secure and efficient transfer of funds, fostering seamless cross-border commerce and financial operations.

Security

Within the realm of international money transfers, security is paramount to safeguard funds and maintain trust among financial institutions and customers. The Swift BIC Code for Bancolombia plays a crucial role in enhancing the security of these transactions by preventing unauthorized access and ensuring that funds reach their intended recipients.

The Swift BIC Code is a unique identifier assigned to Bancolombia, enabling it to participate in the secure Swift network. This network utilizes advanced encryption and authentication protocols to protect sensitive financial information during transmission. By incorporating the Swift BIC Code, Bancolombia can verify the authenticity of other financial institutions involved in the transfer, reducing the risk of fraud and unauthorized access.

Real-life examples demonstrate the effectiveness of the Swift BIC Code in preventing unauthorized access. In cases where individuals or businesses have fallen victim to phishing scams or malware attacks, the Swift BIC Code has acted as a safeguard, preventing the transfer of funds to unauthorized accounts. By verifying the authenticity of the recipient bank, the Swift BIC Code helps to mitigate the risk of financial loss and protect the integrity of international money transfers.

Understanding the connection between security and the Swift BIC Code for Bancolombia is essential for businesses and individuals engaging in international financial transactions. It provides confidence in the secure and efficient transfer of funds, fostering seamless cross-border commerce and financial operations.

Efficiency

The Swift BIC Code for Bancolombia plays a pivotal role in enhancing the efficiency of cross-border payments, eliminating the need for intermediaries and automating various aspects of the process. This streamlining results in faster, more secure, and cost-effective international money transfers.

- Elimination of Intermediaries: By connecting financial institutions directly through the Swift network, the Swift BIC Code removes the need for correspondent banks or other intermediary parties. This reduces transaction fees and delays, providing businesses and individuals with more favorable exchange rates and faster transfer times.

- Automated Processing: The Swift BIC Code facilitates the automation of payment instructions, eliminating manual processing and potential errors. This automation reduces the risk of delays or misdirected funds, ensuring that payments are processed accurately and efficiently.

- Real-Time Tracking: The Swift network provides real-time tracking of payment status, allowing businesses and individuals to monitor their transfers and receive updates on the progress of their transactions. This transparency enhances convenience and peace of mind.

- Cost Reduction: By eliminating intermediaries and automating processes, the Swift BIC Code helps reduce the overall cost of cross-border payments. Businesses and individuals benefit from lower transaction fees and more competitive exchange rates, making international money transfers more accessible and affordable.

The efficiency provided by the Swift BIC Code for Bancolombia not only streamlines cross-border payments but also contributes to the overall competitiveness of businesses engaged in international trade and commerce. By reducing costs, expediting processing, and enhancing transparency, the Swift BIC Code empowers businesses and individuals to engage in seamless and efficient global financial transactions.

Transparency

In the context of the Swift BIC Code for Bancolombia, transparency plays a critical role in reducing the risk of fraud by providing clear identification of the banks involved in international money transfers. This transparency enhances trust, facilitates regulatory compliance, and ensures the secure and accurate processing of funds.

- Verified Bank Identities: The Swift BIC Code uniquely identifies each bank involved in a transaction, ensuring that the sender and recipient banks are legitimate and authorized to handle financial transfers.

- Reduced Impersonation Risk: By verifying bank identities, the Swift BIC Code minimizes the risk of fraudsters impersonating legitimate banks and attempting unauthorized transactions.

- Regulatory Compliance: The Swift BIC Code aligns with global regulatory requirements that mandate the clear identification of banks involved in international money transfers. This compliance enhances transparency and reduces the risk of financial crimes.

- Increased Trust and Confidence: Transparency in bank identification fosters trust and confidence among businesses and individuals engaging in international financial transactions, knowing that their funds are being transferred securely and to the intended recipients.

In conclusion, the transparency provided by the Swift BIC Code for Bancolombia significantly reduces the risk of fraud by clearly identifying the banks involved in international money transfers. This transparency enhances trust, facilitates regulatory compliance, and ensures the secure and accurate processing of funds, creating a more secure and reliable environment for global financial transactions.

In summary, the Swift BIC Code for Bancolombia plays a vital role in ensuring the security, efficiency, and transparency of international money transfers. It uniquely identifies banks, facilitates seamless transactions through the Swift network, and reduces the risk of fraud by providing clear identification of the parties involved. Understanding the Swift BIC Code is paramount for businesses and individuals engaging in global financial activities, as it enables them to make informed decisions, mitigate risks, and optimize their international payment processes.

Looking ahead, the Swift BIC Code is expected to continue gaining prominence as the global financial landscape evolves. With the increasing adoption of digital payment technologies and cross-border e-commerce, the demand for secure, efficient, and transparent international money transfer mechanisms will only grow. The Swift BIC Code, with its established infrastructure and commitment to innovation, is well-positioned to meet these growing demands and support the seamless flow of funds across borders.

Who is lou holtz son

Who is vicente fernandez wife

Who is kokona hiraki meet

Arm Hals Besuch bank routing number bic Hof Zimmermann Vibrieren

![SWIFT/BIC Code For Bank Transfers [ Simple Explanation ]](https://cdn.statically.io/img/i2.wp.com/superblog.supercdn.cloud/site_cuid_ckunzpgt125001pphuz4n48xp/images/what-is-swift-or-bic-code-1656332009718-compressed.png)

SWIFT/BIC Code For Bank Transfers [ Simple Explanation ]

هل في فرق بين SWIFT وBIC و IBAN للبنك؟ فايدتي

ncG1vNJzZmixpZeus7XKrmWsnp9ne6W1xqKrmqSfmLKiutKpmJydo2OwsLmOrK6inqRir6qvjJymnZ1dm7yzecGapZynnKS6o7XAZ5%2BtpZw%3D